What's going on with RILY?

I'm long the stock

[apologies for the extended hiatus]

Several Twitter-based entities have publicly announced campaigns against RILY. Some of these creatures are incredibly vindictive, spiteful people who, when confronted with contrary evidence, go ad hominem and scorched earth. Which is fine- this is a free country. This leads to hilarious interactions where unfalsifiable claims get made and an entire culture of victimhood gets created. It’s really funny.

As it relates to RILY, a list of “ways to win” against RILY stock was put up yesterday, and I found it compelling to talk about:

1.) Marcum is RILY’s auditor. Not a big 4 firm, but not a no-name firm either. It’s funny: these accusations run something like this:

Twitter Account: These lying frauds at RILY are complete frauds. Their financial statements are all fake and the house of cards will collapse soon!

RILY Statement/Official Communication: We are not a fraud and we don’t know what these people are talking about.

Twitter Account: Haha! Got ‘em! You can’t believe anything these lying liars say! Complain about short-sellers much? Why complain if you didn’t have something to hide?

So it’s a “don’t believe your lying eyes” situation, despite the company and insiders having every incentive to report accurately.

Marcum reported a material weakness in internal controls on RILY’s ‘22 10-K (around tax provisioning, valuing intangibles, and marking equities to market) which was corrected in RILY’s amended March 15th filing. There are no off-balance sheet funding situations or any short-term funding for this business, in any event. A 50/50 probability as they say: either they’re a fraud or they’re not!

2.) Brian Kahn was implicated in the Prophecy Asset Management ponzi scheme by John Hughes, the former CCO/co-founder. The crux of the short thesis revolves around this testimony almost entirely (who knows really, it changes by the day). Kahn (allegedly) did something bad. And this is RILY’s problem, how? RILY banked Kahn’s management buyout of FRG (RILY ended up with 31% of the equity in FRG) and lent an incremental $200M to Kahn’s hedge fund, Vintage Capital Management, secured by FRG shares (Vintage owned the FRG shares, Kahn owns Vintage). The loan from RILY to Vintage is a 12% PIK- CEO Bryant Riley called this a “loan-to-own”, directly.

Shorts heavily imply that this is a conspiracy: RILY was complicit in what Kahn was accused of at Prophecy/Vintage (again Kahn runs Vintage) which includes the naming of an employee that worked at both Vintage and Riley at different points in his career. Many tweets are some combination of “Riley and Vintage and Prophecy and Kahn are all the same thing!” Legally, factually, and in real life, they are not.

This was a brilliant move: these accusations, again, are unfalsifiable. RILY shares are illiquid with no sell-side coverage. The FRG acquisition was already under fundamental pressure before its closing. RILY banks a lot of marginal companies in the public market: BW, APLD, CORZ, FAZE et al. have checkered histories of being actual going concerns that create value. With enough handwaving and guilt-by-association, this killed RILY. The only problem is proving out its veracity: Kahn resigned, dissolving any official continuing relationship between himself and RILY (he was CEO of FRG up until Jan 22nd). No charges have been filed against anyone at RILY or Kahn himself, despite the Hughes testimony:

Why wait to file charges against Kahn? It’s been 3 months since the settlement- the testimony is right there? Unless, maybe, the case is just a matter of he said/he said. So we’ll see: the base case I see is RILY taking a loss on this $200M secured loan to Vintage’s FRG shares per some future civil litigation against Kahn. I don’t see this as a deathblow. It also sounds like RILY could have been a victim: why did RILY loan on Vintage’s FRG shares knowing there was a potential legal blowback? Why double-down knowing one of your “co-conspirators (Hughes)” was rolling on Kahn? Doesn’t make much sense.

3.) Sure whatever, anything can happen. Again the thesis is unfalsifiable: “Hughes rolled on Kahn, Kahn will roll on Bryant Riley, and Bryant will take us right to the real ringleader!” Reiterating: separate and distinct legal entities are separate and distinct for a reason. Why would Vintage pay a 12% PIK note if, at the end of the day, these guys are all in cahoots or something like this? Why wouldn’t Kahn try to bilk some 3rd-party margin lender to lend against Vintage’s FRG shares? Even if the worst is true about Kahn (he knowingly acquired a personal stake in FRG with direct ponzi proceeds stolen out of Prophecy), how is this RILY’s problem? The margin loan, sure, probably a loss, but RILY owns 1/3rd of FRG direct out of their principal book. What does that have to do with price of tea in China?

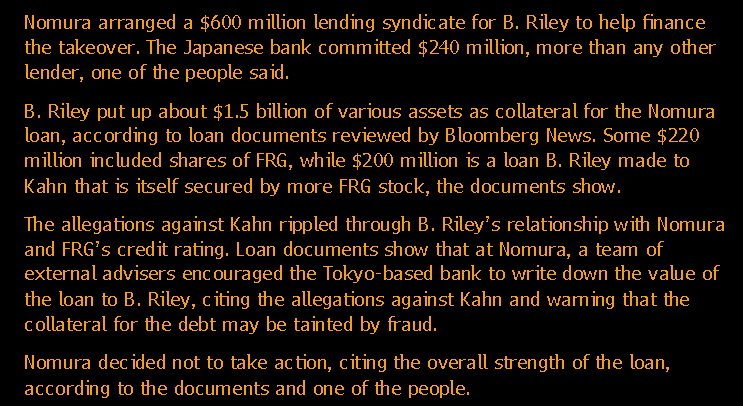

4.) Nomura in the “damning” Bloomberg article: “decided not to take action, citing the overall strength of the loan”

There’s another $1B of collateral in the pool securing this loan, so I don’t know why Nomura would try to call this in. Personally, I don’t know any lenders actively looking to get the keys thrown back to them when their collateral is this secure.

5.) RILY doesn’t take counterparty risk: they don’t fund with deposits, repo, or any form of wholesale or short-term funding. I think this person means customers or clients, such as investment banking clients, wealth management clients who broker with RILY’s B/D business and other service relationships the business has with customers. Admittedly, customers are probably less wont to do business with RILY after the company has been accused of a myriad of felonious activity on Twitter for three months; by all accounts/channel checks RILY is retaining business despite this. I think shorts were probably hoping for another Silvergate/Signature Bank situation as runs on those banks brought them down; fortunately for RILY they do not have to deal with that same problem created by public accusations of malfeasance.

6.) Finally, we get to a fundamental component of RILY’s business. Yes, they have large principal book, including some shittier businesses they bank for fees. Most recently they guaranteed a portion of BW’s debt in exchange for some fees. However, there are recent wins in this book worth highlighting: CONN is up 50% or so since RILY’s investment. CORZ exited bankruptcy and paid off RILY’s DIP financing in full. They also plan on selling Sylvan learning, a franchise out of FRG, in Q1 of this year. I hope they use this liquidity to buy back debt/stock in the core business, which should do well in an improved investment banking environment in 2024.

In July of ‘23, before the closure of the FRG transaction, I wrote that RILY could be worth $100 in a bull market for investment banking. I still think that could be true. White Brook Capital had great commentary on their core business, which I agree with.

Why are you assuming that for them taking a $200mn loss is not a big deal?