Two ideas- Indonesian coal?

Turning over rocks

Wolfpack research posted their second video on RILY stock linked here. They’re bearish for a number of valid reasons any shrewd investor would be of a financials business: exponential balance sheet growth, fuzzy marks-to-market on illiquid assets, loans to bankrupt companies still on the balance sheet, principal investment book in some weird wireless businesses and illiquid listed equities. The asset management business has a lot of cross holdings in those same illiquid names, and the company owns a shady brokerage business with some FINRA complaints thrown in. Not to mention most of the RILY investment banking clients are pretty embroiled in funny business.

The illiquid principal book is scary, no doubt, but the most interesting part of the business to me is simply the investment banking. Most of the “funny business” I allude to at RILY is a relic of the SPAC/de-SPAC boom era of 2020-2021. Lots of fees, very few prudent deals, lots of caveat emptor in deal documents. RILY is not oblivious to this fact— in addition to the investment banking business they have a restructuring and liquidations business. The marketing funnel is fairly straightforward!

This sort of business self-awareness is what makes RILY’s business interesting as an investment. The danger here, as always with any banker allocating principal capital, is that RILY believes their own capital markets/sales bullshit. They clearly do to some extent with the size of their principal book, but have counter-cyclical businesses in place as well.

RILY stock will work if they can muddle through the scariness in their illiquid principal book with a boomtime investment banking cycle. If a wave of plant-based/ AI-machine learning/battery metals/water scarcity/pickleball businesses decide to tap the capital markets in the near future, RILY’s stock will work. Does it feel like scuzzy business? Someone will bank these clients; moralistic judgements of investors allocating capital aren’t a feature of this newsletter.

Indonesian Coal Stocks

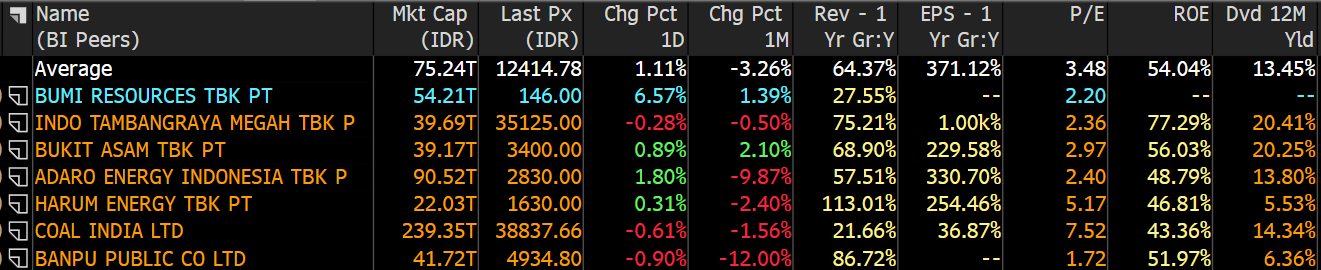

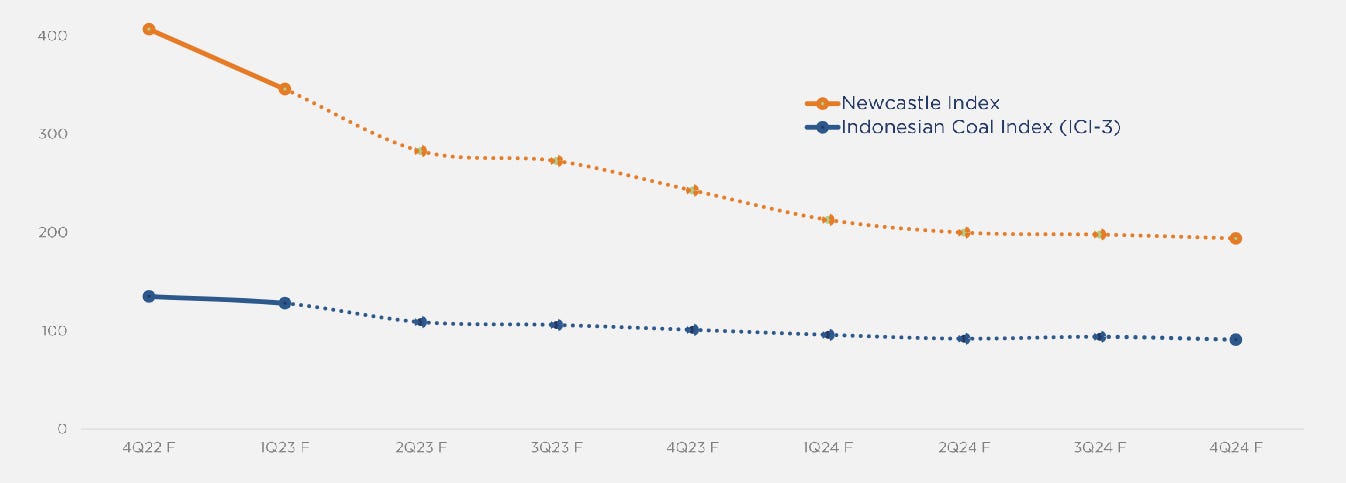

Not for the faint of heart, but Pakistan announced it would quadruple coal plant capacity to cut energy costs. There are three Indonesian-based, listed companies with double digit dividend yields trading at 2-3x earnings (according to Bloomberg- above). Newcastle coal prices have pretty much quadrupled since mid-2020:

Indonesian coal trades substantially cheap to Newcastle coal, even on a forward basis out to 2025 (this doesn’t adjust for tariffs, or shipping costs/FOB):

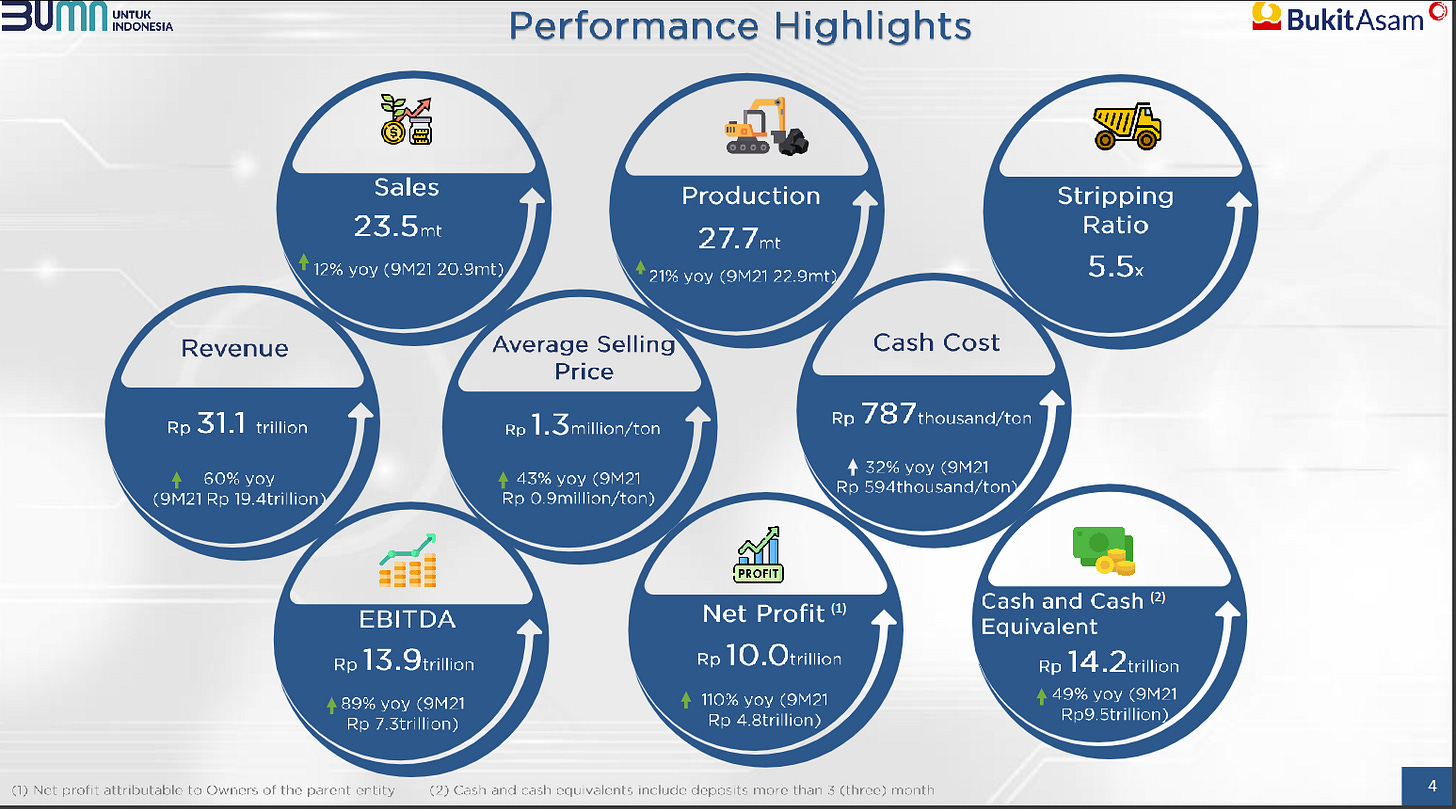

Getting a bit into the companies- BukitAsam reported growth numbers last quarter that would make a SaaS business blush!

Not for the faint of heart- this is an area of the world where energy is fraught with geopolitical risk. China and India both import, as well as endogenously produce, coal from Australia, the West, and other parts of the world. Coal is rapidly being phased out all over the planet, and renewables have made progress as far-flung as southeast Asia.

Bukit Asam basically sells none of its coal to Pakistan (yet) but it’s an interesting exercise in seeing a headline, seeing possibly related stocks, and doing some initial reading to get up to speed on the situation. Maybe these stocks are worth more than 2x their trailing earnings, maybe not. As a brilliant genius once said, “Time will tell.”