Names names names

Symbols for the weekend

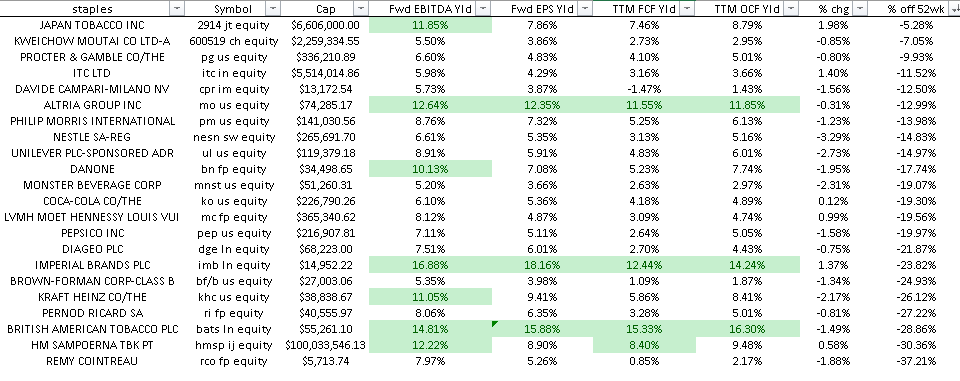

Big Staples:

In the previous note I talked mostly about broader market valuation and rates, which isn’t a subject I spend that much time thinking about. But the genesis of it stems from finding a quit rate: basically I want 10% return after tax, I can get that in a staples name that I trust (Nestle or Coke or whatever). But I really only want that 10% forward total return at a discount, whether it be 10 or 20 cents- nothing too crazy. A reasonable price for a Nestle would probably be 80 francs or so, an implied EV of ~272 billion francs for a company earning ~16 billion or so in EBIT. Hardly a bargain but certainly a price I’d go to the beach at! I bring this up as its the first time that price is within spitting distance of the actual market price. In fact, most staples names I follow have seen this move in long-term interest rates demolish their forward multiples, deservedly so:

Here’s a funny chart from the name that has sold off the least (mostly because of FX), Japan Tobacco Inc. The company has had exactly 2 billion shares out standing for at least 28 straight years! Japanese tidy-mindedness at its finest.

.

Media:

I’ve written in the past about two media assets that are both controlled, but offer value to those who believe the assets are actually unique. The NAV discount at Liberty SXM is closing and Irenic Capital has successfully campaigned for governance changes at Newscorp. Liberty Live Nation (LLYVK) is the most compelling NAV discount in the Malone-osphere, and the borrow is cheap. Live Nation is a $20bn company, LLYVK owns 30% of this ($6bn) and has a market cap of $2.8bn. So the math works here.

NWS is still trading substantially cheaper to where Irenic valued the company about a year ago; it’s still a cheap stock.

ATVI, another name tangential to media, mentioned in one of my first letters, will close at $95.

B. Riley:

Not much has changed here outside of the general interest rate environment and the FRG deal closing. The math still works, the companies are being milked for cash, and the stock doubles if the banking business gets back to anywhere near its 2021 peak (not a likely outcome, but certainly not impossible).

L&R Companies:

Both JXN and EQH remain statistically cheap aberrations. EQH owns the 1/3rd stake in AB, which makes it the interesting SOTP play. JXN has an asset side issue with its CMBS portfolio, and has a all the accounting overhang of reserves, LDTI, and its MBR hedge program. So it’s worth a flyer if these things can re-rate to where the rest of the industry is, but so far so good on their respective capital return programs.

Energy:

Offshore contractors like Noble and Transocean seem to be the best risk reward in this space, with the simple thesis of oil remaining at or around its current price ($80-90). If those prices are here to stay, the offshore industry locks in day rates that haven’t been seen since pre-COVID. Capacity is needed, specifically in west Africa and Asia, and the shipyard lead times insulate pricing for awhile. Shockingly clean balance sheets between the two of these companies. Can’t say the same about Diamond Offshore.