Monitoring the Situation: GRVY and GungHo

Ragnarok comes for entrenched management

Throughout 2025 and into early 2026, GungHo Online Entertainment has been embroiled in a standoff with the activist fund Strategic Capital. What’s interesting is that this would have sort of been unthinkable a decade ago: Japanese companies are famously full of bloat and immune from activism. However true that is now, Strategic launched an aggressive campaign—including a dedicated website and multiple shareholder proposals—calling for the removal of CEO Kazuki Morishita. Strategic Capital argued that Morishita had turned GungHo into a one-hit wonder by failing to produce a successor to Puzzle & Dragons in over thirteen years, all while drawing a salary that famously exceeded that of Nintendo’s CEO. Even for a Japanese comp structure that seems egregious! The campaign was compelling and similar to what I touch on in the Beretta/Ruger posts: huge operating profit declines, possibly cyclical but not great regardless, and management unwilling to engage in constructive dialogue.

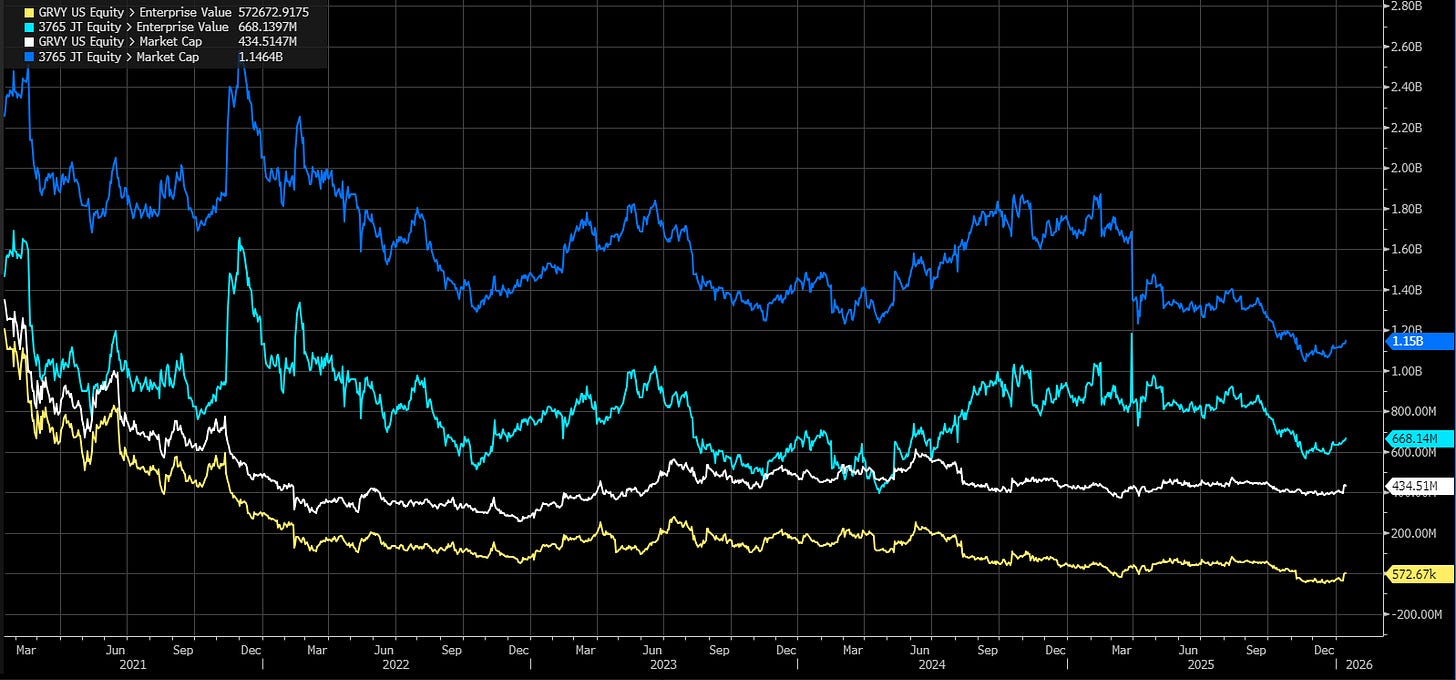

With its stake in the American-listed Korean ADR Gravity Ltd. (GRVY), GungHo’s balance sheet looks very healthy, as its fully consolidates all of GRVY’s cash. Here’s a funny chart showing the enterprise value of both— yes, GRVY currently has a $572,000 EV (it was negative a few months ago):

The situation reached a head a few days ago when GungHo announced a leadership “reshuffle”. Morishita officially stepped down as President and CEO, but he was not fired in the traditional sense; instead, he was moved to the roles of Chairman of the Board and Chief Development Officer. Classic Japanese management! GungHo attempted to satisfy the Strategic’s demand that he step back from management while simultaneously rejecting the idea that he was a liability to the company’s culture. The CFO, Kazuya Sakai, was tapped to take over the CEO role, signaling a shift toward more fiscally-minded leadership.

It’s a good outcome— Morishita stays at the company and Strategic gets a W. Beyond the title change, Strategic successfully forced GungHo to overhaul its comp structure. The company introduced a new performance-linked system that slashes the presidential salary by 63% and ties future bonuses to Total Shareholder Return (TSR). These concessions—admitting that the previous management structure was failing and implementing strict financial accountability—represent a sea change for a company that had spent most of 2025 publicly dismissing the activist’s concerns as “unfounded.” This is way more than a minor superficial victory, they’re actually changing the comp structure at a Japanese company. Times are changing!

Coming back to what it might mean for GRVY, the incentive set for GungHo is straightforward. With a new, properly-incentivized CEO at the helm, GungHo should be forced to unlock that value. This could take the form of pushing Gravity to dividend out the cash to both GungHo and GRVY minority owners, or, in a more radical scenario, a full secondary offering or sale of the stake to a Chinese giant like Tencent or NetEase. Would be interesting to see if the new CEO wants to “clear the deck” and get a cash infusion for its stake, effectively transforming the business (and the stock price) from its current status as complicated detritus in a cyclical industry (gaming) to some kind of growth story. Either way the initial pop is hard to ignore; the new CEO might be champing at the bit to get this going and get paid.